Samsung SDI, announces Business Performance of 2Q, 2022 Recorded highest revenue and operating profit

Post. 2022.08.01

Samsung SDI, announces Business Performance of 2Q, 2022

Recorded highest revenue and operating profit

□ [2Q] Recorded quarterly revenue of 7.408 trillion KRW, operating profit at 429 billion KRW

- Recorded the highest quarterly and semi-annual business performance, surpassing 400 billion KRW of operating profit for the first time

- Energy department recorded business profit rate of 6%

□ [2H] All Business performance is expected to grow continuously

□ 2Q Business Performance Overview

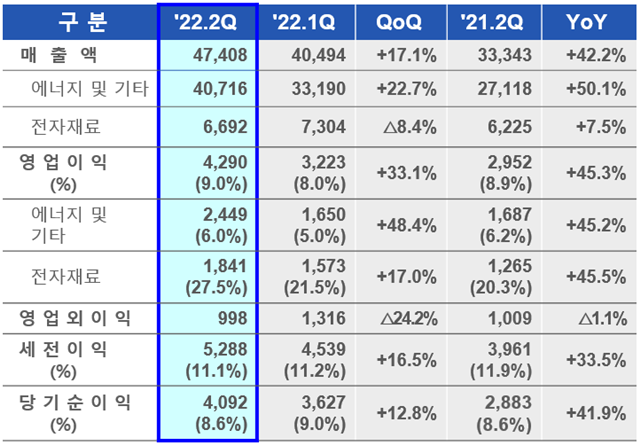

Samsung SDI recorded 2nd quarter revenue of 4 trillion 740.8 billion KRW and operating profit of 429 billion KRW. It is the first time to surpass 400 billion KRW in operating profit hit the highest semi-annual result.

Samsung SDI's 2Q 2022 Business Performance

(Unit: 100 million KRW)

Revenue was increased by 1 trillion 406.5 billion KRW (42.2%) year-on-year and operating profit was increased by 133.8billion KRW (45.3%) year-on-year. Also, revenue was increased by 691.4 billion KRW (17.1%) quarter-on-quarter and operating profit was increased by 106.7 billion KRW (33.1%) quarter-on-quarter.

□ 2Q 2022 Business Performance by department

Energy department’s revenue recorded 4 trillion 716 billion KRW, up 50.1% YoY and 22.7% QoQ. Operating profit recorded 244.9 billion KRW, 45.2% YoY and 48.4% QoQ with business profit rate of 6%.

Compared to the previous quarter, large-sized battery department saw increased revenue and improved profitability. Amid the solid growth of demand, EV battery revenue was increased around high-value products, such as Gen5 batteries. In preparation for mid-to-long term growth, we signed the JV contract with Stellantis and initiated construction of pilot lines for solid-state batteries. ESS battery revenue went up due to the increased sales of utility in the US. Profitability also went up owing to higher ASP indexed with the increased materials costs.

For small-sized battery department, both the revenue and profitability improved in QoQ and YoY. Cylindrical battery sales expanded centered on EV and power tool applications. Pouch battery sales decreased due to the slowing demand in IT applications and to the growing number of awaiting customers for new smartphone release in 2nd Half.

Electronic Materials department’s revenue recorded 669.2 billion KRW, up 7.5% YoY but down 8.4% QoQ. Operating profit recorded 184.1 billion KRW, up 45.5% YoY and 17% QoQ.

Compared to the previous quarter, Electronic Materials department’s profitability was improved due to the expansion of sales of high value products. The OLED revenue was increased as we started sales for new platforms. The semiconductor revenue was on par with the previous quarter. Polarizer maintained profitability with increased sales of differentiated products.

□ 2H 2022 Business Outlook

For the 2nd half, large-sized battery department will continue to increase sales centered on high value products.

Sales boost of Gen5 battery is expected with the start of operation in Hungary Plant #2, and Samsung SDI will make its utmost effort in winning deals for the next-generation platform.

For ESS, the demand for renewable energy is expected to increase as the oil price maintains high and more countries are following the global trend in expansion of green policies.

So, in order to meet such increased demand, we are planning to increases sales by launching a new high-value product for utility applications, with higher energy density and lower costs.

The sales of ESS is expected to rise by by launching a new ESS products for utility application.

Small-sized battery will continue to see the sales growth around mobility application. Cylindrical battery sales is expected to grow as the demand for mobility such as EV and e-Bike is likely to increase. As it is anticipated that the demand for 46Ø batteries will increase, Samsung SDI is planning to initiate construction of corresponding production lines for new EV projects.

The sales of Electronic Materials is expected to increase, mainly in OLED and semiconductors. For OLED, Samsung SDI will expand sales for major customers, while making continuous efforts to enter new platforms. For Semiconductor, Samsung SDI will increase sales by releasing new products on time.And, by diversifying customer portfolio for polarizer, Samsung SDi will maintain sales and profitability against decreasing demand.

□ Sustainable Management Activities

Samsung SDI appointed Mr. Duk-hyeon Kim as the Chairman of ‘Sustainability Management Committee’ for the active operation of the committee, which was organized in the 1st half of this year.

Additionally, by launching ‘Sustainability Management Conference’ under the leadership the CEO, main executives discussed mid-to-long term sustainable strategies and shared the results to all employees.

Also, Samsung SDI published ‘Sustainability Report 2021’ on the official website in 2nd quarter. Through the report, the company provided SDI’s sustainable activities and achievements and strengthened communication with stakeholders.

Samsung SDI’s President and CEO, YOONHO CHOI said, “amid difficult business environment such as instability in market demand and supply and increased possible risk factors, we achieved the highest business performance in record. And, “we will swiftly execute 3 major business policies and solidify foundations for future growth like new generation platform and solid-state batteries to maintain profitable qualitative growth.”