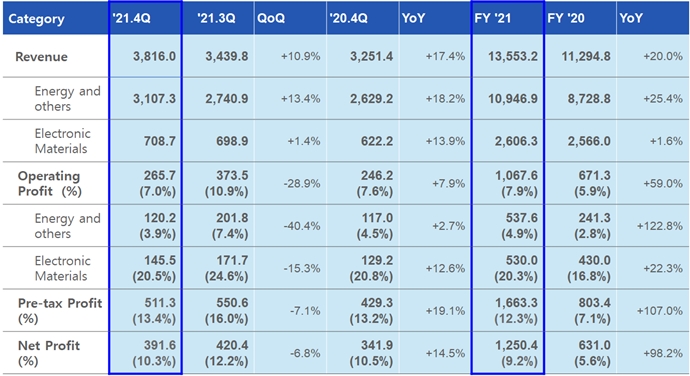

Samsung SDI 4Q21 Earnings (Unit: KRW bn)

4Q21 Earnings by Business Division

The Energy and others reported revenue of 3 trillion 107.3 billion won, up 18.2% YoY, 13.4% QoQ. Operating profit reported 120.2 billion won, up 2.7% YoY and down 40.4% QoQ.

The large-sized battery division revenue grew than the previous quarter and maintained profitability. EV battery revenue grew with the supply increase mostly for Gen.5 battery, despite the chip shortage issue. For ESS, both revenue and profitability went up with the sales increase for high-value products such as RES and UPS.

Small-sized battery also saw growth in revenue QoQ and YoY. Cylindrical battery revenue went up for EVs and power tools, but pouch battery revenue went down for flagship smartphones due to seasonality.

Electronic materials business revenue stood at 708.7 billion won, up 13.9% YoY, 1.4% QoQ. Operating profit stood at 145.5 billion won, up 12.6% YoY, down 15.3% QoQ.

The Electronic materials business saw high profitability thanks to revenue increase for high-value display materials compared YoY and QoQ. Polarizer revenue rose with the sales increase for large TVs, and OLED materials revenue also rose with the supply increase for smartphones and TVs. Semiconductor materials slightly declined due to clients’ inventory adjustment.

1Q22 Business Outlook

In the first quarter of 2022, large-sized battery will see similar level of sales and profitability to the previous quarter, and a significant increase than the first quarter of 2021.

EV battery sales are expected to continue to rise for batteries applied for major clients’ new models. ESS sales are expected to go down due to seasonality, but to go up significantly YoY, with improved profitability for high-value products.

Small-sized battery will be affected by sales increase from EV cylindrical batteries and pouch batteries for new flagship smartphones. Accordingly, higher sales and profitability are expected QoQ and YoY.

Electronic materials sales will be similar to the previous quarter despite seasonality, and profitability will go up thanks to sales increase QoQ. Display materials will maintain its sales level for polarizer, and semiconductor materials sales will have similar sales level to the previous quarter, but go up YoY.

FY22 Market Outlook

In 2022, the overall battery market will grow including EV, ESS, small batteries.

The EV battery market will be about 80 billion dollars, up 38% YoY this year. The market will grow driven by governments’ fuel efficiency regulation and environmental policies, and automakers’ electrification strategies. Samsung SDI plans to improve profitability by increasing sales of high-energy-density products and achieving business growth.

The small-sized battery market is expected to be about 41 billion dollars, up 12% YoY. Samsung SDI will strengthen market leadership in the cylindrical battery market for Non-IT products such as EVs and power tools by launching high-capacity and high-power products.

The electronic materials market is expected to witness demand increase for high-value materials. Samsung SDI will improve technological competitiveness for premium products in the display materials market, and respond to market demand by developing new products in a timely manner in the semiconductor materials market.

Dividends for 2021 & Shareholder Return Policy for 2022 - 2024

Samsung SDI has decided to set dividends for 2021 as 1,000 won for common share (1,050 won for preferred share). And it disclosed a new shareholder return policy, effective from 2022 to 2024.

Samsung SDI has set regular dividends as 1,000 won (1,050 won for preferred share) by implementing new shareholder return policy, and will pay out 5-10% of free cash flow as additional dividends. The company is to enhance shareholder value by maintaining minimum shareholder return with regular and additional dividends.

Samsung SDI CFO Jong-sung Kim said “With our new shareholder return policy, shareholders can better predict shareholder return,” and “We will do our utmost effort to improve company’s and shareholders’ values by proactively carrying out sustainable management including ESG.”