Samsung SDI, 4Q20 Earnings Release

Post. 2021.01.28

Samsung SDI, 4Q20 Earnings Release

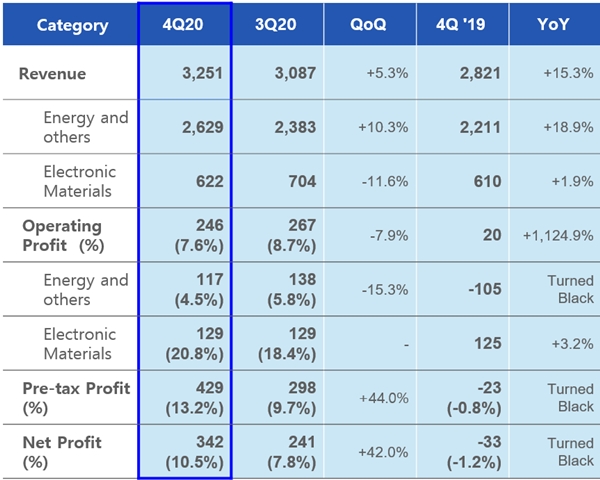

□ [4Q20] Revenue was 3 trillion 251.4 billion won,

Operating profit was 246.2 billion won

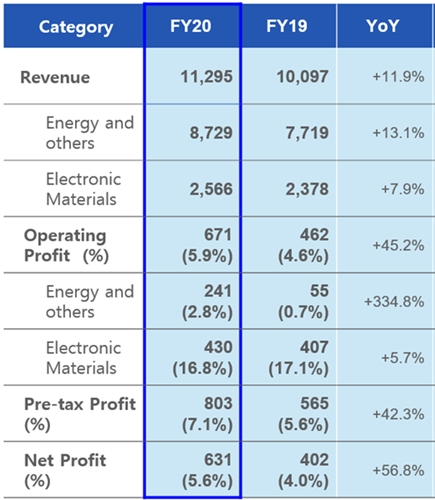

[FY20] Revenue was 11 trillion 294.8 billion won,

Operating profit was 671.3 billion won

□ Annual revenue reached 11 trillion won for the first time,

and quarterly revenue reached a record high

□ In 2021, the Automotive & ESS battery business is expected to grow

as the EV market expands

4Q20 Business Highlights

Samsung SDI announced revenue for the fourth quarter of 2020 of 3 trillion 251.4 billion won, and operating profit of 246.2 billion won.

Revenue increased by 430.5 billion won(15.3%) and operating profit increased by 226.1 billion won(1,124.9%) YoY. And revenue increased by 164.2 billion won(5.3%) and operating profit decreased by 21.2 billion won(△7.9%) QoQ.

Samsung SDI 4Q20 Earnings (Unit: KRW bn)

Samsung SDI FY20 Earnings (Unit: KRW bn)

4Q 2020 Results

The Energy business reported revenue of 2 trillion 629.2 billion won, a 245.7 billion won increase(10.3%) QoQ. And the operating profit recorded 117 billion won, which is a 21.2 billion won(△15.3%) decrease QoQ.

EV battery revenue saw a significant increase driven by environmental policies such as increasing EV subsidies in the second half of last year in Europe, and ESS revenue also saw an increase from the U.S. project. However, small battery revenue declined QoQ due to decreased sales of pouch batteries.

Electronic materials business recorded revenue of 622.2 billion won, a 81.5 billion won(△11.6%) decrease QoQ, and operating profit recorded 129.2 billion won, the same level compared to the last quarter, maintaining its profitability.

Polarizer revenue went down due to seasonality, and semiconductor materials revenue also went down slightly as clients made inventory adjustment, but OLED materials increased the supply for new flagship smartphones.

Q1 2021 Market Outlook

EV battery sales will decline due to seasonality. For ESS batteries, the overseas sales will go up from the U.S., but the domestic sales will go down.

Small battery sales will slightly increase QoQ as the cylindrical battery demand for power tools and TWS earphones goes up.

Electronic materials sales and profitability will decline QoQ due to seasonality of polarizers and OLED materials.

FY 2021 Market Outlook

In 2021, we expect the market growth of the ESS, small battery, semiconductor∙OLED materials, as well as EV battery.

This year, the EV market is expected to grow by 80% to 236GWh YoY with environmental policies of Europe, the U.S. and China.

The ESS market is expected to grow by 57% to 29.8GWh YoY as the demand will go up driven by overseas environmental policies.

The small battery market is expected to grow by 16% to 11.2 billion cells YoY as the demand for mobility goes up, and the power tool demand rebounds thanks to the recovery of the housing market.

The electronic materials market will expand led by semiconductor and OLED materials.

Semiconductor materials demand is expected to go up as clients’ wafer input increases, and display materials demand will also increase as more OLED panels are used at mid-range smartphones.